Deputies quarrel, ministers are leaving, Truss' chair is shaking, inflation is rising.

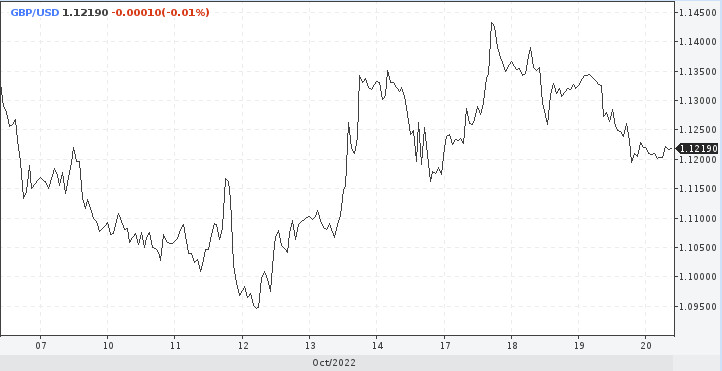

The pound has started a black streak again, although the presence of a white one can be questioned. The burden of problems hangs over the British currency and it does not get better, on the contrary, there are new reasons to think about the potential achievement of parity for the GBP/USD pair.

The dollar gaining strength, the equally rapidly growing inflation in the UK, which the Bank of England continues to ignore, the specter of a recession. All this is happening during a possible change of power in Britain. The new prime minister has not had time to settle in the chair, as MPs want to send her after Boris Johnson. The government's twists and turns are not at the right time, but apparently there is no other way out.

Inflation

The pound fell for a moment after the release of inflation data. The new indicator turned out to be disappointing, the price index in the UK continued to accelerate, reflecting, among other things, the passivity of the local central bank.

In September, inflation moved to double digits, increasing from 9.9% to 10.1% against the consensus of economists of 10%. More importantly, the core inflation rate rose just as quickly, amounting to 6.5% compared to 6.3% in the previous month.

The highest figure in four decades, but succeeding figures are expected to be higher.

"The overall inflation rate will rise to almost 11% in October, primarily due to a 27% increase in energy prices. But in the first quarter, the overall figure should decrease to 9%, since the peak of growth in food and motor fuel prices has probably been reached," Pantheon Macroeconomics economists comment.

High inflation could be made an argument for strengthening the pound due to the aggressive rhetoric of the BoE, which, in theory, should have followed after another record price increase. Now nothing is keeping the central bank from raising the rate sharply at the November meeting, which was raised to 2.25% in September and is expected to rise to about 4% by the first months of the new year. In practice, things may be different.

However, some economists say this may now be less likely after recent scenes in the government. Most of the September budget plan was canceled this week in favor of a return to "austerity."

This leaves the economy on the path to a barely mitigated recession, which, according to the August monetary policy report, could last for about a quarter.

Everything is too complicated, and the authors of this confusion are British politicians.

Downing Street

The inflationary picture in the UK has been erased by reports of new layoffs in the ranks of high-ranking political officials. Following the sudden departure of former Chancellor Kwasi Kwarteng, who was forced to resign on October 14, Interior Minister Sewelluella Braverman left her post.

The pound tried to grow amid large-scale losses on Wednesday. This movement, apparently, was a reaction to the departure of another high-ranking member of the government, followed by a decline in the yield of UK government bonds, which did not correspond to the internal inflationary picture.

Braverman was replaced by Grant Shapps, whom the prime minister had previously pushed to the back of the government.

Who's next? What other reshuffles are waiting for Britain and will this save the country from collapse?

Anyway, the pound likes what is happening with the change of the main characters.

The drop in yields on Wednesday did not correspond to the global background against which US bond yields were pushing other countries higher.

Dollar

Government reshuffles have a short-term impact on the pound. The reality is that the British currency lags behind not only the strong dollar, but also the weak euro.

The pound continued its downward trend, despite extremely high inflation and the rates of the financial markets on the increase in US bond yields after even more hawkish comments from the Federal Reserve representatives.

The pound's illogical reaction to the consumer price index data highlights that the currency is "trading in a structural, not cyclical way. In a cyclical world, higher inflation will be accompanied by higher yields and a stronger currency," HSBC noted.

When markets are most concerned about structural risks, "higher inflation and higher yields are seen as symptoms of a broader problem," the economists explain.

The pound is likely to continue trading structurally until the country's authorities make more efforts to contain the domestic budget deficit or until inflation reaches a peak. In this case, stabilization of the bond market and the pound is possible. In the meantime, the downward trend is the main one. Sterling is waiting for a difficult few months, during which the GBP/USD exchange rate risks falling to 1.0800 and below.

The dollar rally, fueled by even more aggressive Fed rhetoric, will put more pressure on the lifeless pound.

Traders are revisiting US interest rate hikes closer to 5%. In November, the rate can be raised immediately by 100 bps.

The dollar rally in the middle of the week followed statements from Minneapolis Fed chief Neel Kashkari. The official signaled that he had "very little confidence in what inflation will be in six months" and argued that the central bank should keep raising rates until there was "convincing evidence" that the inflationary peak had passed.

As for rates, September forecasts suggested an upper limit of 4.5% by the end of the year. Concerns were also raised about a rise to 4.75% early next year.

Core inflation rose from 6.3% to 6.6% y/y in September, while the official or headline inflation rate remained stubbornly elevated at 8.2%.

After the reversal of the dollar index, expectations about reaching new highs again became more active. The current range is 112.00-114.00. These notes will remain relevant until the next FOMC meeting. If bulls manage to break above 114.00, gains will accelerate to a 2022 peak at 114.80.